Resolution

As a resolution authority, PIDM has at its disposal a wide range of legislative powers (loss mitigation & failure resolution powers) to resolve member institutions in order to minimise impact on depositors, policy owners, financial markets, other financial institutions and ultimately, to preserve public confidence and ensure financial system stability.

About Resolution

Protects depositors against the loss of their insured deposits placed with member banks, in the unlikely event of a member bank failure.

Learn more

Resolution Framework

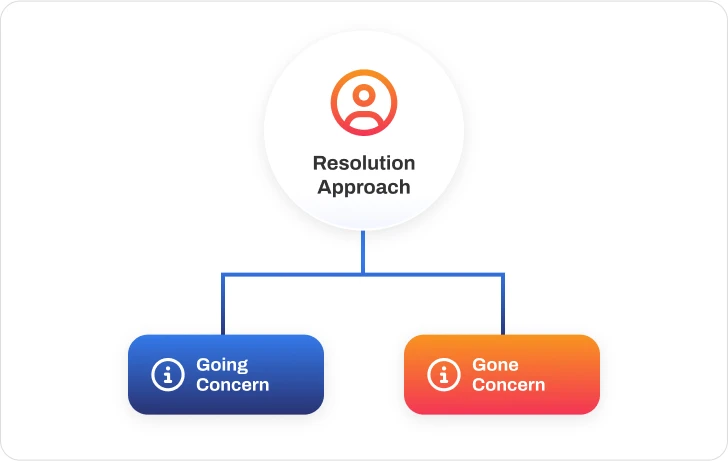

PIDM has a range of powers under the PIDM Act to manage a failing member institution. Our powers fall into two broad categories: pre-emptive & resolution powers.

Learn more

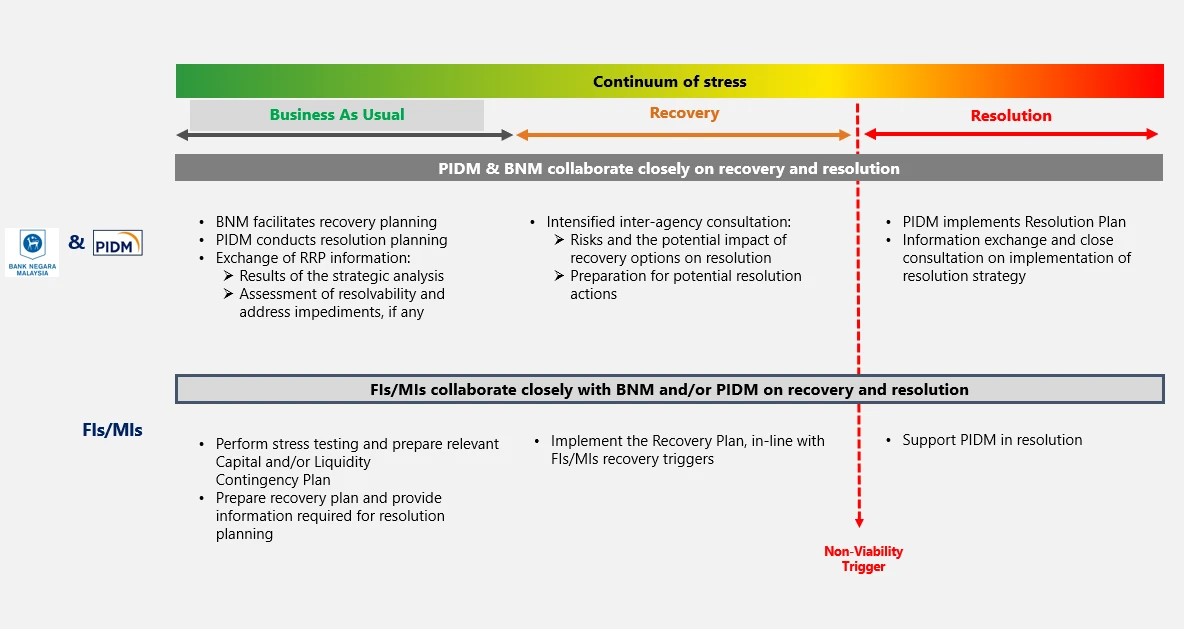

Resolution Planning

Banks often plan for growth - not for failure. But history has shown that failure can happen, often without warning, and the consequences can be severe and that is why resolution planning matters

Learn more

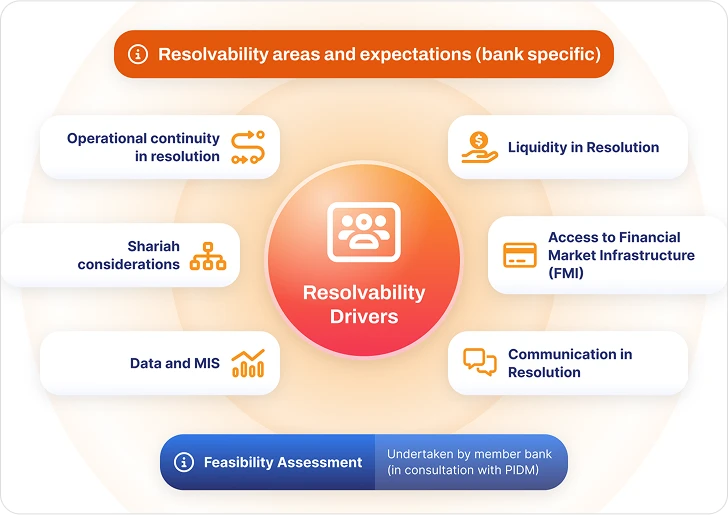

Resolvability

One of the purposes of resolution planning is to ensure that PIDM member banks are resolvable. To be ‘resolvable’ a firm needs to have arrangements and plans in place so we can carry out a resolution if it fails. In Malaysia, this means the institution can support PIDM to implement a transfer in resolution

Learn more