Resolution Framework

Resolution Framework

PIDM has a range of powers under the PIDM Act to manage a failing member institution. Our powers fall into two broad categories: pre-emptive & resolution powers

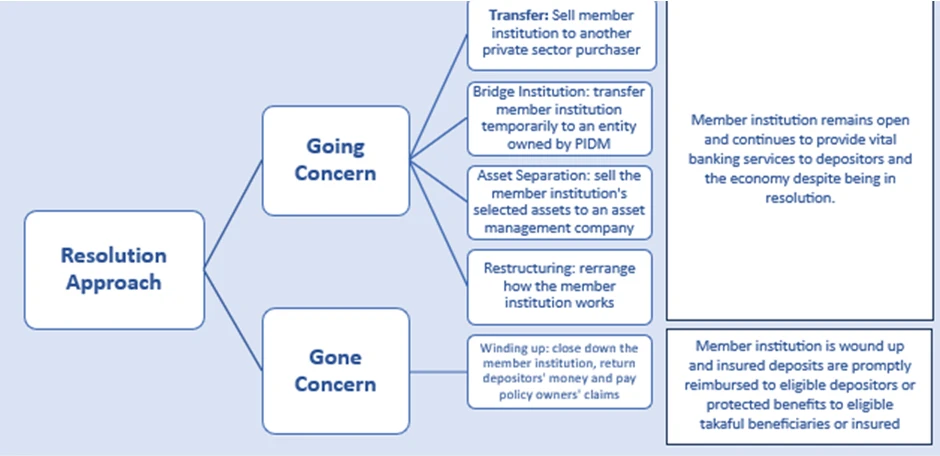

In general, a failed member institution can be resolved either via a going concern resolution or a gone concern resolution.

Going Concern Resolution

The goal is to continue the member institution’s operations and ensuring the continuity of important financial services to depositors, policy owners and customers.

PIDM has several tools under this approach:

- Transfer to a private sector acquirer

This is PIDM’s preferred option. It allows depositors, policy owners and customers to continue accessing their financial services without interruption, with the business transferred to another private sector acquirer. The transfer can involve all or part of the failing institution’s business or shares. PIDM may provide support to facilitate the transfer, including loans or guarantees. - Transfer to a bridge institution

If there is no private sector acquirer available, the business may be temporarily transferred to a bridge institution — a wholly-owned subsidiary of PIDM that is licensed to operate as a bank. This helps stabilise the situation while options like restructuring or an eventual sale are being explored. - Transfer to an asset management company (AMC)

Certain assets may be moved to an AMC to help recover value over time through sale or wind-down. This tool is usually used together with other going concern tools. The AMC can be a PIDM subsidiary or a private entity. - Restructuring

PIDM may restructure a failing institution to address its causes of failure and restore its viability and make it more attractive for a future sale.

Gone Concern Resolution

If keeping the member institution open is no longer possible, PIDM may carry out a gone concern resolution which involves winding up the institution in an orderly manner.

- Winding up and reimbursement

PIDM may apply to the High Court to wind up a failing member institution.For member bank, PIDM will reimburse the insured deposits using the most efficient channels available — including DuitNow (using the depositor’s national ID or business registration number), online bank transfers or cheques.For insurer member, PIDM will pay the policy owners’ claims.The institution’s assets will then be sold off by a liquidator, and the proceeds distributed to creditors based on the legal order of priority.

Shariah and Resolution: A Malaysian Consideration

In Malaysia, resolution must also account for the unique features of Islamic finance. Islamic financial institutions offer Shariah-compliant products based on distinct contractual principles, which may require tailored solutions during a resolution. PIDM works to ensure that resolution strategies for Islamic member institutions are Shariah-compliant — to mitigate potential legal and reputational risks.

This includes, for example, the need to develop mechanisms to deal with Islamic contracts in resolution and ensuring seamless access to Shariah authority for advice on Shariah issues. Ongoing engagement with the industry and Shariah authorities is key to strengthening operational readiness and ensuring compliance throughout the resolution process.