Resolvability

Resolvability: What It Means and Why It Matters?

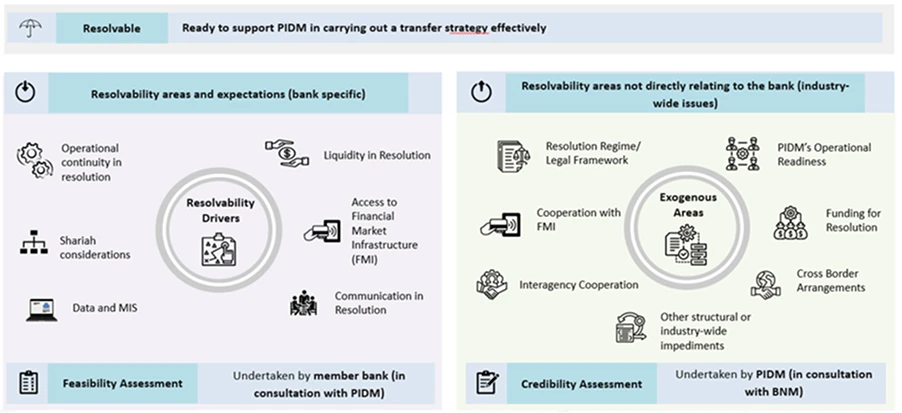

- One of the purposes of resolution planning is to ensure that PIDM member banks are resolvable.

- To be 'resolvable' a firm needs to have arrangements and plans in place so we can carry out a resolution if it fails. In Malaysia, this means the institution can support PIDM to implement a transfer in resolution – by identifying and addressing any barriers to transfer during business-as-usual (BAU), and building the necessary financial, legal, and operational capabilities to enable a smooth transfer.

Examples of arrangement that makes a bank more resolvable

- In the area of Management Information Systems (MIS), PIDM member banks must be able to produce timely and accurate data to support valuation and decision-making to facilitate a transfer in resolution.

- For legal contracts, resolvability aims to ensure “resolution-resilient” clauses are in place to prevent the automatic termination of services on the grounds of the bank's resolution.

Source: Examples of resolvability - from PIDM AR 2024

- Resolvability involves both institution-specific and system-wide efforts member banks are responsible for institution-specific issues (feasibility assessment), while authorities (PIDM working with other financial safety net authorities) focus on addressing broader industry-wide issues.

Source: From PIDM RSP Stakeholder Engagement Materials (2025)

Long-Term Commitment

- Building resolvability is not a one-off exercise — it requires long-term commitment and investment. Some impediments are structural and take time to resolve. Others involve developing new systems and capabilities that must be embedded into day-to-day operations.

- But the benefits are clear: resolvable institutions are better prepared for crisis, more resilient in the face of stress, and contribute to the overall stability of the financial system.