Resolution Planning

Banks often plan for growth — not for failure. But history has shown that failure can happen, often without warning, and the consequences can be severe. That is why resolution planning matters*.

*Currently resolution planning is only implemented for PIDM member banks. Resolution planning for insurer members will be determined at a later stage.What is resolution planning?

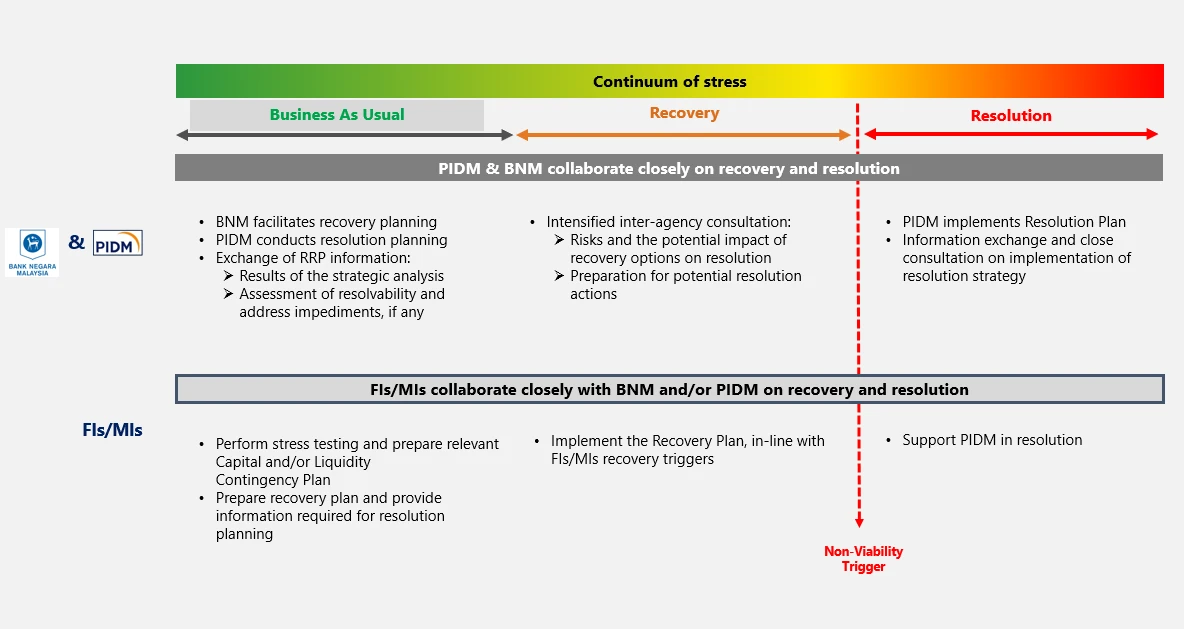

- Resolution planning is about being prepared before a crisis hits. It is planning done in advance that allows PIDM, in collaboration with member banks and Bank Negara Malaysia, to develop credible, tailored strategies for resolving a failed institution — if the need ever arises.

- This planning takes place during good times. It is about putting in place the tools, arrangements, and decision frameworks before stress emerges, so that when the time comes, we know what to do.

- Each resolution plan is customised to the size, structure, and complexity of the institution, and sets out how it can be resolved in an orderly way — while maintaining critical financial services and public confidence.

Why Resolution Planning Matters?

Banks are deeply connected to the wider economy. Their failure, if unmanaged, can ripple through the financial system, disrupt essential services like payments and credit, and undermine public trust.

Resolution planning helps us avoid that. It ensures that if a failure does happen, it can be managed in an orderly way — without disrupting the financial system, and without relying on public funds.

Benefits of Resolution Planning

When implemented effectively, resolution planning helps member banks build the financial, operational, and strategic capabilities needed to support a smooth and orderly resolution — if ever required.

Importantly, many of these capabilities also bring value during business-as-usual, by improving internal processes, governance, and risk oversight.

Here is what resolution planning can deliver:

Stronger governance

Clearly defining the roles and responsibilities of the board and senior management of the bank enhances crisis readiness — and can also strengthen the institution’s overall risk management framework.

Improved operational efficiency

Investments made to support resolution readiness, such as upgrades to data systems and internal processes, can also improve day-to-day efficiency, productivity, and even franchise value of the bank.

Better risk management and monitoring

Integrating resolution planning into the broader risk framework helps banks better understand their vulnerabilities and respond to emerging risks more effectively.

Stronger alignment with recovery planning

Resolution planning builds on the bank' s recovery plan by validating recovery options and testing their feasibility. Together, both processes support more robust crisis preparedness.

Who is involved in resolution planning?

Resolution planning is a collaborative process [to insert hyperlink]. While PIDM leads and draws up the resolution plan, Bank Negara Malaysia and member banks play vital roles.- Member banks bring deep knowledge of their business, operations and structure. They are expected to support the resolution planning process by conducting internal assessments, improving their own resolvability, and developing the necessary capabilities to support a resolution if needed.

- Bank Negara Malaysia supports coordination and ensures alignment with supervisory and recovery planning efforts.

- PIDM, in consultation with BNM, also works to identify and address industry-wide barriers to resolution.

What does Resolution Planning entail?

Resolution planning includes:

- Identifying critical financial services and key business lines that must be preserved

- Understanding group structures and dependencies (within and across entities)

- Assessing suitable resolution options that can be applied in failure

- Identifying and addressing impediments to resolution well in advance

- Building operational and financial capabilities to support resolution implementation

In short, we plan so that we have options and can act swiftly to contain any failure with minimal disruption.