About Resolution

Introduction to resolution

Financial institutions are subject to robust prudential and regulatory standards so that they remain safe and sound. However, no matter how stringent the supervisory regime, a financial institution, like any other business, is not immune to failure.

That is where resolution comes in. Resolution is the process by which PIDM manages the failure of our member institutions.

PIDM as the resolution authority

As the resolution authority for our member institutions, PIDM is responsible to ensure that in the event a member fails, it can do so in a “safe” manner – with minimal impact to depositors, policy owners and customers and without disrupting the financial system and broader economy. Our goal is simple: to protect financial stability and preserve public confidence by ensuring the continuity of important financial services, even in the face of a member failure.

When Does PIDM Step In?

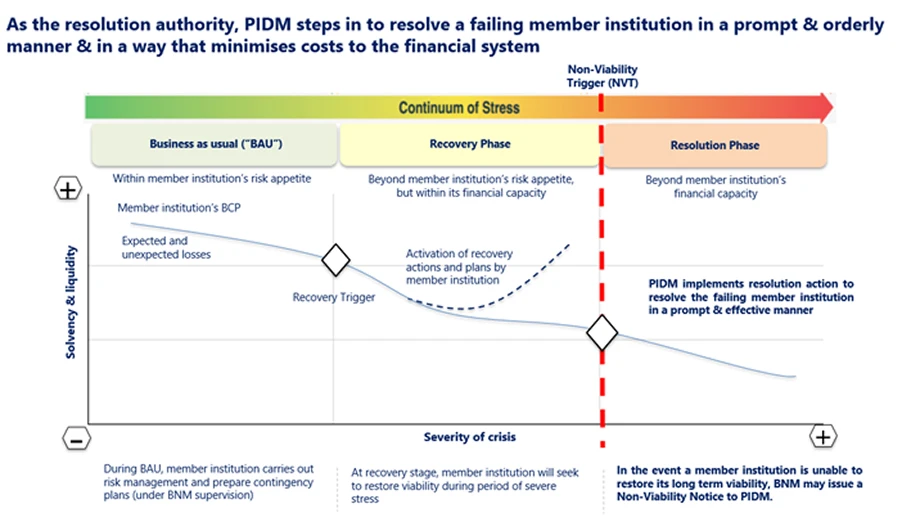

PIDM steps in when a member institution’s own recovery actions are no longer able to restore its long-term viability. At that point, the focus shifts from recovery to resolution. This happens when Bank Negara Malaysia informs PIDM that the institution is no longer viable or is at risk of becoming so. This is known as a non-viability notice. Once the notice is issued, PIDM steps in to begin the resolution process.

We Don’t Work Alone

Resolution is a coordinated effort. Whether during business-as-usual or in a resolution, PIDM works closely with other financial safety net authorities including Bank Negara Malaysia and the Ministry of Finance, to ensure a swift and effective response to a member failure or crisis – to preserve financial system stability and maintain public confidence.